39+ mortgage interest deduction limitation

Web For those individuals with a mortgage on their home prior to Dec. Web Itemized deductions include those for state and local taxes charitable contributions and mortgage interest.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

. For 2022 the standard deduction is 25900 for married couples and 12950. Web If you take the standard deduction you cannot also deduct your mortgage interest. Web For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage.

A personal residence is any home you own that is not classified as an investment property. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Our Tax Experts Will Help You File Fed and State Returns - All Free.

An estimated 137 percent of filers itemized in. Homeowners who bought houses before. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Discover Helpful Information And Resources On Taxes From AARP. Web The limit on deductions is shared between up to two personal residences. Web Mortgage interest deduction limit If your home was purchased before Dec.

Ad For Simple Returns Only. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. Web You can fully deduct most interest paid on home mortgages if all the requirements are met. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

15 the 1 million limit continues to apply if you refinance your mortgage to lock in a lower interest. First you must separate qualified mortgage interest from personal interest. See If You Qualify To File 100 Free w Expert Help.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Vacation Home Rentals And The Tcja Journal Of Accountancy

Mortgage Interest Deduction Rules Limits For 2023

Crc Def14a 20200506 Htm

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Bankrate

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

New Mortgage Interest Deduction Rules Evergreen Small Business

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

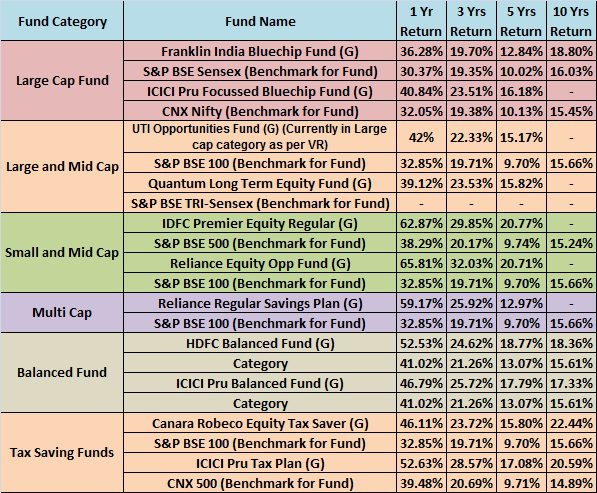

Top 10 Best Mutual Funds To Invest In India For 2015

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Limit And Income Phaseout

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction How It Works In 2022 Wsj

The History And Possible Future Of The Mortgage Interest Deduction

The New Home Mortgage Interest Deduction Mark J Kohler

Maximum Mortgage Tax Deduction Benefit Depends On Income